The conflict between the S2F ratio model and the EMH theory…The important thing is, after all, the ‘natural value’.

Three months have passed since the time of the “halving” for Bitcoin mining is now. The expected time is May 12, 2020 when the 630,000th block of Bitcoin will be mined. This time point is determined by the hashrate, which means the difficulty of mining, which is controlled automatically by the algorithm, and the computational ability to be utilized for mining. At this point, the compensation received from mining one bitcoin block will be reduced from 12.5 BTC to 6.25 BTC. The 12.5 BTC is currently priced at 120 million won based on the Bitcoin market price. If the bitcoin market is maintained in May 2020, the compensation will fall to 60 million won, half of what it used to be.

The reason people pay keen attention to the timing of compensation for Bitcoin mining is because of the price of bitcoin. They believe that the incident of mining compensation antipathy will have a major impact on bitcoin prices in one way or another. What effect did the two previous mining compensation antipathy actually have on Bitcoin prices?

First, the first antipathy point is in December 2012. As of this point in time, the price of bitcoin in the previous year has roughly tripled from $3 to $10 per year. Over the next year, the price of bitcoin rose about 80 times to about $800. The second half-time is July 2016. In the first year before this point, bitcoin prices doubled from roughly $300 to $600 and nearly quadrupled to about $2400 over the next year.

In both of the previous two cases, prices have risen sharply and someone has seen a big profit at the time of the year, so it is understandable that they are very interested in this time of antipathy. If so, is it possible to predict what the price will be at this time of the half- There are many different opinions and hypotheses, but there are some arguments that are the most resonant in the West.

◆Anticipation expected around May 12 of this year

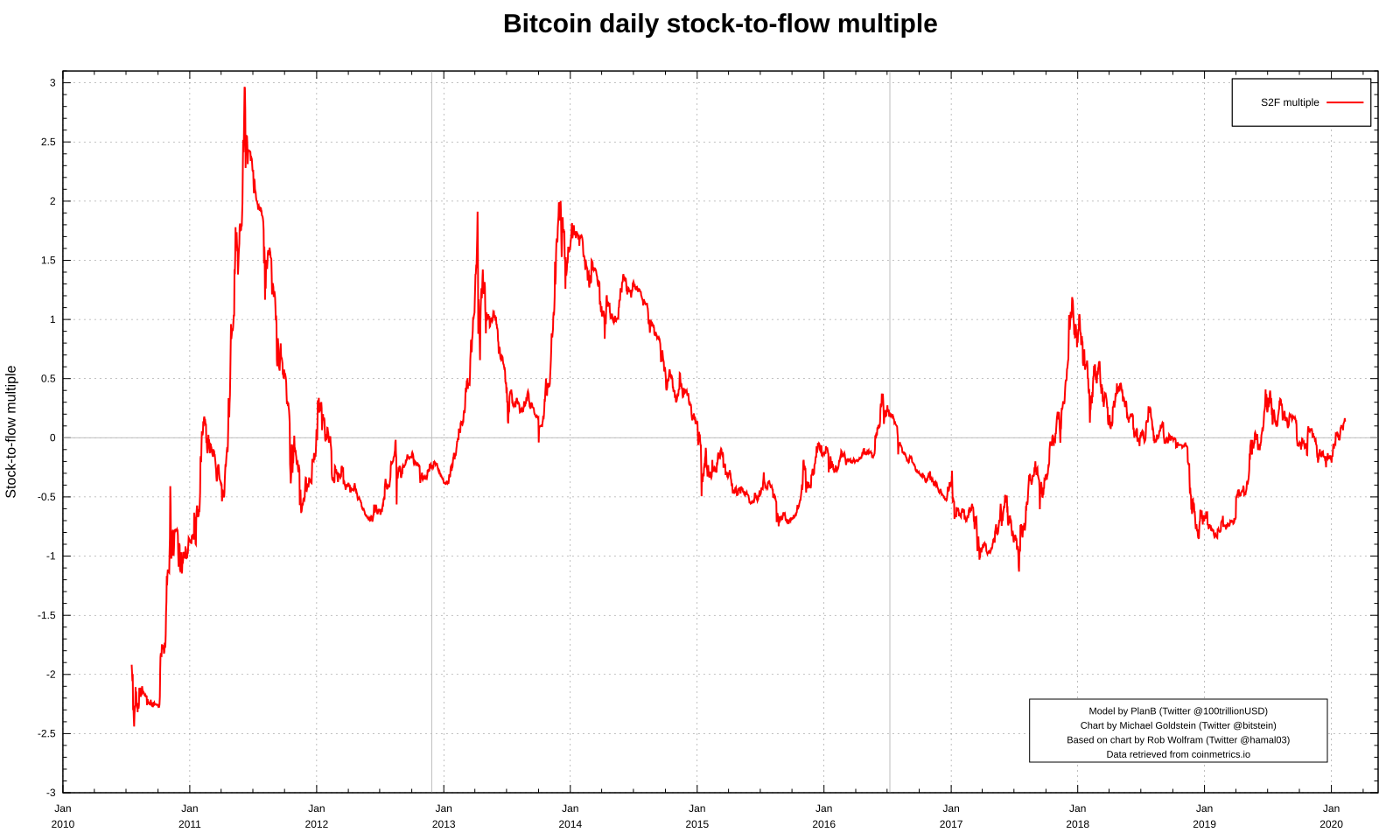

First, let’s look at the S2F (Stock-to-Flow) rate model, which is frequently cited by those who argue that bitcoin prices will rise. An investor in cryptocurrency assets called Plan B, which operates on Twitter and Midium, claims that value can be assessed using the scarcity of bitcoin.

By nature, Bitcoin is the first asset to solve the problem of scarcity that is difficult to solve for digital assets and is still highly recognized as digital gold to date. If bitcoin is digital gold, it seems reasonable to evaluate its value using other methods of valuing precious metals.

S2F stands for ‘stock to production’. Evaluate the scarcity of the asset using the ratio of the stock (Stock) that has already been produced and remains unused and the new production (Flow) produced each year. In other words, the S2F ratio can be defined as ‘SF=non-accumulated ÷ production volume’. The higher the SF ratio, the higher the scarcity of the asset.

According to an analysis by Plan B, the more valuable the SF value was, the higher the market capitalization. What is the SF value of Bitcoin? It is now 25, and will rise to 50 after passing the half-mast point in May 2020. This is very high, although the SF value of gold is less than 62. He argues that proper use of SF values can explain bitcoin prices from 2009. In addition, the market capitalization of Bitcoin is $1 trillion after the latest half of mining compensation.

He boldly predicts that each will cost about 1,188 trillion won and cost 55,000 U.S. dollars.

There are arguments against these claims as well. The most representative argument is the Efficient Market Hypothesis. EMH argues that it is impossible to use any information to make investments that surpass market yields (for example, the KOSPI index) in terms of market-wide returns. This is because, assuming that the market is operating efficiently, the information would already be reflected in the market value of the asset.

So how does EMH explain the existence of investors with higher returns than market returns? It is risk. All investments have different returns and risks. High-risk assets are traded at a lower price and if the ‘good’ risk is not realized after purchasing them, the investor can earn higher returns.

Applying these EMH arguments to bitcoin half-life can explain: “Bitcoin half-life is already reflected in the price because everyone knows it

EMH is a well-known claim in traditional finance compared to the S2F, but it is almost impossible to prove through experiments, and opinions are divided about it. Typical counterargument to EMH is as follows:

First of all, access to ‘information’ varies from person to person. Strong form EMH claims that even internal or private information is stored in the value of an asset, which few would agree with. It is common sense to think that if someone is not familiar with information yet, there are plenty of opportunities to benefit.

In addition, even the same ‘information’ may differ from person to person. Some see bitcoin antipathy as a scarcity increase due to reduced supply, but others view it as a decline in profitability or a weakening of security due to reduced mining compensation. It seems possible for investors who make more accurate interpretations, albeit different from others, to generate higher returns even using public information.

After all, EMH presupposes an extremely efficient state of exchange of information and the extremely reasonable ability to interpret a given information, but this premise itself is flawed because it is out of touch with the real economy and the nature of the participating entity.

◆ The value of ‘scarcity’ being maximized

It is hard to say that the S2F model is also logically persuasive. If scarcity is the dominant factor in determining bitcoin prices, bitcoin prices will rise steeply when miners have reduced mining compensation to near zero through agreed hard fork. However, even if that happens in practice, it is highly unlikely that prices will rise suddenly. On the contrary, it is highly likely that there will be some who underestimate the value of bitcoin, saying that it has undermined the value of “decentralization.”

Some interpret that bitcoin prices have moved in proportion to the volatility of international situations. When there were signs of a deepening trade war between the U.S. and China, when Iran and the U.S. clashed by force, and when the outbreak of a new strain of coronavirus infections (pneumonia) increased economic risks in major countries, especially China, prices of Bitcoin rose by an unprecedented margin. Through this process, increased awareness of decentralized value storage means and more users have a direct effect on the intrinsic value of bitcoin.

Expectations are very high over the upcoming Bitcoin half-life. Big-name foreign investors are also fueling the mood, forecasting how much bitcoin prices will be by the end of the year. However, while it would be good to make short-term profits based on specific events, I hope that it will eventually serve as an opportunity to properly assess what assets are inherently valuable and how events are affecting their intrinsic value. In that case, a smart investment will be possible to make high profits while keeping risks low.